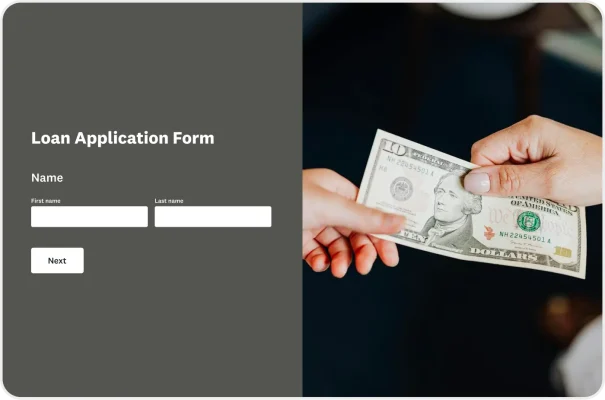

Loan Application Form Template

Whether you’re a bank or other financial service provider, evaluating whether a potential borrower qualifies for a loan requires capturing and managing sensitive personal data. Our loan application form template streamlines the process, enabling you to quickly and securely collect and manage personal information from loan applicants.

Capture all the information you need to make a smart lending decision, including the borrower’s contact information, employment status, income, co-borrower information, and more. Allow applicants to securely upload supporting documents like paystubs, bank statements, or tax documents.

The intuitive SurveyMonkey form builder gives you the ability to adapt the form to match your lending institution's specific requirements and incorporate your branding to maintain a consistent user experience.

Explore related templates

Explore which features support this survey template

We have so many powerful features to help you launch surveys quickly, but here are our most popular ones for new users.

Customizable survey experiences

Out-of-the-box themes, accessible color palettes, custom fonts, branding, and more.

Many ways to send your surveys

Collect survey responses via email, website, SMS, social media, QR codes, offline, and more.

Survey analysis, no training required

Automatic results summaries, filters, custom dashboards, crosstab reports, text analysis, & more.

Additional resources to help you launch successful survey projects

Success Stories

Read about our customers, explore webinars, and get guides on collecting feedback in your industry.

Blog

Get tips on how to create better surveys, hear the latest product news, or check out our research.

Help Center

Access tutorials on how features work, learn more about billing, and contact Customer Support.

Discover more resources

Solutions for your role

SurveyMonkey can help you do your job better. Discover how to make a bigger impact with winning strategies, products, experiences, and more.

Travel survey questions: 40+ examples to improve guest and traveler feedback

Use these 40+ travel survey questions and templates to collect feedback, boost guest satisfaction, and improve every traveller’s experience.

When you need to ask follow-up questions

Follow-up questions are a great tool to gather more insightful, specific data from surveys. Here's how and when you need to ask follow up questions.

The pros and cons of survey prizes

Explore the pros and cons of offering survey prizes, assess whether you need them, and learn best practices for using survey incentives effectively.