5 ways to get the survey data you want

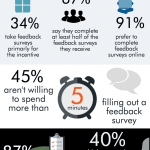

Give us your feedback! We want to know what you think! Help us improve! It’s likely you’ve received a feedback survey at some point, either online or in a store. In fact, according to our research, 89% of people have. Though we’re not too surprised by this, we wanted to know more about how and why people are completing those surveys.

Using SurveyMonkey Audience, we surveyed more than 400 people to ask them about feedback surveys. Okay—you may be thinking, “That’s so meta.” But asking people about their survey habits helped us understand why people are most likely to fill out a feedback survey, why they are (or aren’t) answering questions truthfully, and how they think their responses are being used.

All-in-all, we learned that people are likely to take your feedback surveys if you’re giving them what they want. Based on our survey results, we came up with 5 ways to maximize the chance that customers will complete your feedback surveys–so you can increase your survey response rate and get data you can count on.

So who’s completing surveys? And how do you keep them happy?

First, let’s take a look at who’s actually completing your feedback surveys. By feedback survey, we mean any survey that asks people to give their thoughts after they’ve used a product or service, visited a store (online or in person), or spoken with a customer service rep.

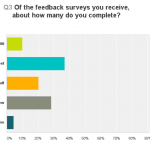

Of the 89% who receive surveys, 67% say they complete at least half of them or more! (Tweet this.) And whether you’re sending feedback surveys to customers, healthcare patients, or just about anybody else, there are 5 tactics you can take to keep respondents happy:

- Go online. How to get people to take a survey starts by making it accessible to them.

- Keep your survey short. If respondents see that your questionnaire consists of multiple pages, they’ll be more inclined to leave several questions unanswered.

- Use survey incentives to motivate respondents to take your survey.

- Be clear and direct. Respondents won’t know how to fill out a survey if they don’t understand what’s being asked of them.

- Follow up with respondents. If respondents don’t think that you read through their feedback and took into account, the question of how to get people to take a survey will become all the more challenging in the future.

Let’s dive into each of these points in more detail so that you can better understand and account for them on your next survey!

1. Go Online

Why? According to our survey results, people overwhelmingly prefer to complete a feedback survey online at a colossal 91%, either through website submission (63%) or sending an email (28%). Meanwhile, only 3% of people said they prefer to send their survey responses via snail mail. (Tweet this.)

Pro tip: According to our data, people are most likely completing online surveys on Thursdays and Fridays between 7 a.m. and 1 p.m. PST. If you want more responses faster, try sending out survey requests during peak response times.

2. Keep it Short (When You Can)

Disclaimer: There are times when you need to send longer surveys, especially when you need to measure the many dimensions of employee engagement or student success into account. But there are also times when you may want to keep your surveys short and sweet–namely, when you’re giving them to customers (unprompted) and they’re doing you a favor by giving you feedback.

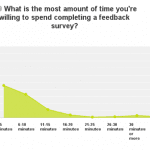

Take a look at how much time people want to spend on your survey:

Yikes–look at that dropoff! 45% of people are willing to spend 5 minutes, at most, on your feedback survey, while 33% are willing to spend up to 10 minutes. (Tweet this.)

However, when we filtered the question by only including those who said they fill out all or most of the surveys they receive, people said they’re okay with spending a bit longer on feedback surveys: Only 33% say they spend 5 minutes or less on surveys, while 36% of people are willing to spend 6-10 minutes on a survey. And even 17% say they’d spend 15 minutes filling out a survey. So if you do have a few more questions to ask, don’t lose hope!

Pro tip: Just make sure every question is a gem–and designed to get you relevant information that will answer your biggest questions–so you don’t waste your respondents’ time (or yours). If you need a short customer satisfaction questionnaire template, try the one-question Net Promoter Score Survey. For more on creating sound surveys, visit our Surveys 101 resource center to get it right.

3. Consider Incentives

Ah, incentives. The pros and cons of incentivizing surveys are many. And 34% of people say that the primary reason they complete feedback surveys is because they want the prize, gift, or discount involved. (Tweet this.)

On the one hand, you don’t want to encourage satisficers (people who rush through surveys and don’t take them seriously) to give you feedback just because you offer them an incentive.

But on the other hand, people may not be compelled to give you their feedback unless they have an extreme opinion about you, good or bad. If you want to get an accurate measure of how you’re really doing, you need to get answers from a representative sample of your demographic, not just the extremes.

Besides, our results indicate that people who are giving you their feedback are taking the time to give you honest answers: A whopping 95% of people say they give accurate feedback survey responses extremely or very often. (Tweet this.)

And of the people who say they primarily take feedback surveys because of the prize involved? Well, 94% of them say they give honest answers extremely or very often as well.

Pro tip: When asked what incentive they want most, People said they want a gift card (31%), cash (23%) or a discount (22%). You could also try our approach: Make a donation to your respondent’s favorite charity every time they complete a survey.

4. Be Clear and Applicable

Speaking of honesty, let’s talk about why people may not be giving you accurate answers:

40% of people say they give an inaccurate answer to a survey question because the question is confusing, while 31% say it’s because the question doesn’t apply to them. (Tweet this.)

The bad news is that the questions you write may be yielding unreliable data. But that’s also the good news! Because 71% of people say that the reason they give inaccurate answers are because of logistical problems presented to them by your survey–rather than due to their own dishonest behavior–you can control data quality on your end.

Pro tip: You can improve the quality of the survey data you analyze by writing good survey questions and by following our best practices in cleaning it.

5. Follow Up

Remember how 34% of people say they complete feedback surveys because of the prize or gift involved? Well, 22% of people say they complete feedback surveys primarily because they enjoy doing so–and 20% said it’s because they want to help the organization that’s asking. How nice!

In fact, although 56% of people say they have been receiving the same amount of feedback surveys as they did last year, 22% say they’ve been receiving more–and that it’s a good thing.

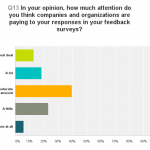

We’ve got the warm and fuzzies over people’s altruism, but in the end, your respondents say they think their feedback is making an impression–but maybe not as much as you’d like to believe:

As you can see, only 40% of people think companies and organizations pay a moderate amount of attention to the responses they receive through feedback surveys. (Tweet this.)

But if you want to continue to send out surveys so you can set benchmarks and measure your organization’s performance over time, it’s a good idea to show people you care about what they have to say–so they’ll continue to help you improve.

Show people you’re grateful for the time they took to fill out your survey beyond a thank you page or incentive. Publish a report of your findings on your website, or ask respondents for their contact information so you can follow up with them. Tell them how you’ve used their input to make positive changes.

Pro tip: Use an expert-certified customer feedback template, and customize it to include an effective survey introduction that tells respondents how you’ll be using (and when you’ll be publishing) the results. Or customize the template to ask them for their email address so you can send out a newsletter with your findings.

Sending customer feedback surveys is only part of keeping customers happy and engaged. Learn how to increase customer satisfaction by downloading our free eGuide, “6 Keys to Customer Satisfaction, Loyalty & Love.”

Want to visualize some of our data? Check out our sweet infographic on who’s filling out your customer feedback surveys: