More Resources

A quick way to get your head around the concept of conjoint analysis is to turn your thoughts to an American classic—the famous Big Mac.

This iconic burger is widely known for the combination of individual ingredients that, when merged together, make for one consistently tasty and reliable sandwich. Two all-beef patties, special sauce, lettuce, cheese, pickles, onions on a sesame seed bun. The perfect combination in the eyes of millions of consumers.

If you’re looking to mirror that type of enduring success by developing products or services built with the just-right combination of product and features, then conjoint analysis methodology should be part of your marketing research toolbox. Conjoint analysis in marketing and brand management can provide continuous product and service improvements, and enhanced pricing and profitability.

What is conjoint analysis?

Conjoint analysis, sometimes called trade-off analysis, is a form of statistical analysis used in market research to understand how customers value different components or features of a company’s products or services. Conjoint analysis is based on the principle that any product or offering can be broken down into a set of attributes that ultimately impact users’ perceived value of an item or service.

Through conjoint analysis you can determine what combination of a limited number of attributes is most influential on a respondent’s choice or decision making. Analysis of those respondents surveyed can reveal a trove of useful insights.

Trust our Market Research experts

Don’t worry about survey methodology, audience targeting, or sifting through all the data. Let our market research experts do the heavy lifting.

How does conjoint analysis work?

It is typically conducted via a conjoint analysis survey that either asks consumers to rank the importance of the specific features (or any attribute) in question or to choose between competing sets of features and prices. Analyzing the results allows those doing the research to then assign a value to each feature.

It can help take the guesswork out of what best combination of features would be most attractive to your customers. Instead of assuming the combination they would value most, you get real-world insights from those you survey. Those insights provide clear direction.

The analysis can help you formulate a marketing strategy by seeing what the majority of your customers seek in your offerings and then take corresponding actions. This can save time, money, while also fast-tracking your ability to get your product or service that has the best potential success out in the market quickly.

Conjoint analysis strategy

The insights a company gleans from conjoint analysis of its product features can be leveraged in three main ways:

- Conjoint analysis for pricing strategy

- Sales and marketing efforts

- Research and development plans

These are just a few top ways marketers put this type of methodology into action.

Why use conjoint analysis with survey data?

There are a lot of potential advantages to using conjoint analysis in your surveys.

- It helps researchers estimate the trade-offs that consumers make on a psychological level when they evaluate numerous attributes simultaneously.

- It allows for measurement of consumer preferences at an individual level as well as compiling and analysing data from individual responses to gain statistically relevant insights representative of a larger group.

- It gives researchers insights into real or hidden drivers that may not be too apparent— oftentimes even to those being surveyed.

- Conjoint analysis allows for study of the consumers and attributes deeper to create a needs-based segmentation.

- It provides user-based affirmation of what is most valued in the product or service, which offers guidance or actions to take or changes to to make improvements.

These actions can lead to deeper customer engagement, more focused marketing messages and increased brand loyalty.

Bridge gaps in data by leveraging research expertise

Get the most out of your bottom line with experts that will get the most out of your data.

Types of conjoint analysis

There are two main types of conjoint analysis. Choice-based Conjoint (CBC) Analysis and Adaptive Conjoint Analysis (ACA). When executing on a marketing research project each of these methodologies should be considered, depending on your specific situation and what you aim to achieve.

What is discrete choice-based conjoint analysis?

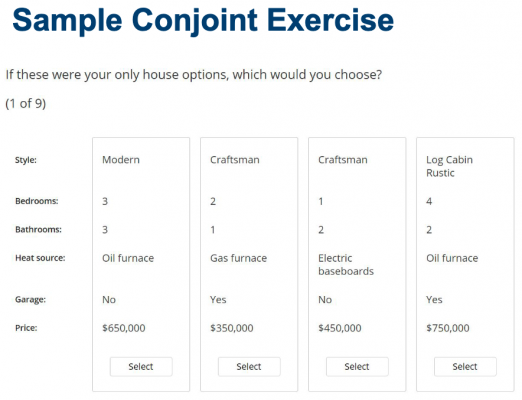

Discrete CBC analysis is the most commonly used method because it offers a straightforward and familiar approach. Discrete choice-based conjoint analysis asks consumers to simulate a shopping experience to imitate the real purchasing behavior exploring which products they would choose, given specific criteria on price and features.

For example, each product or service for participants to consider and evaluate will have a set of features, some of which might be similar to each other or while others differ. The result is data and insights directly from consumers that can be highly effective in determining the ideal product features and issues relating to the marketing and sale of that product.

Discrete choice-based conjoint analysis is a great option if the price is one of the most critical factors for you or your customers. The method’s key benefit is that it provides a picture of the market’s willingness to make trade-offs between various features. The result is an answer to what constitutes an “ideal” product or service.

What is adaptive conjoint analysis?

ACA differs from discrete choice in that an interview or questioning process is staged and not aimed at imitating a real consumer experience. Under this approach, the research participant builds its optimal product configuration—then must-haves and features that are unacceptable are assessed—and finally trade-offs are explored by systematically varying remaining product configurations.

Researchers typically turn to adaptive conjoint analysis in instances in which the number of attributes/features exceed what can be reasonably assessed in a choice-based scenario. Put simply, instances in which a product or service would have too many potential features to reasonably evaluate.

For consumer products, adaptive conjoint analysis is often used to define the optimal product, meanwhile organizations such as financial service providers often rely on it to optimize product/portfolio configurations.

Conjoint analysis examples

So how might conjoint analysis play out various different scenarios across several different types of businesses? The following examples provide some insight into the thought process and execution of these initiatives using conjoint analysis.

Example 1: A consumer product manufacturer

A fitness equipment manufacturer is looking to redesign its oldest and best-selling rowing machine to tap into the growing number of younger people interested in home gyms and the increased interest in rowing as effective cardiovascular exercise.

They have identified the criteria, or set number of features, which define the product. These features include:

- Easy-folding portability.

- Touch video screen display with health metrics.

- On-demand virtual coaching and classes.

- New silencing technology that quiets the rowing process.

- Affordability compared to competitor offerings.

The analysis from the survey data will reveal which combination of features are most attractive to prospective buyers. This data-driven insight can guide the company in determining if convenience and quiet are top priorities, or if buyers are more interested in pricing or the inclusion of high-tech interactive features.

Example 2: A B2B service provider

A phone answering service is looking to differentiate from the competition by expanding their services. To gain greater customer perspective they aim to conduct a B2B conjoint analysis based on the following criteria:

- On-demand, in-person phone answering support

- Customer followup communication via text and social media messaging

- A new pay-per call answered model

- A scheduling service that manages company calendars

- A business development option that draws on sales experts to recognize up-selling opportunities during phone conversations

Responses to these options can provide direction on what types of additional services customers would value the most, while potentially opening up new revenue streams or creating new efficiencies for the company.

Example 3: Product development

A long-standing national pest control company has noticed that an increase in dramatic weather fluctuations are driving more mice to seek shelter indoors. The result? You guessed it, plans to build a better mousetrap based on the following options:

- Trap snap alerts sent to your smartphone when the trap is triggered making for quick cleanup or a fast reset if the mouse escaped unscathed

- A low frequency beeping sound emitted from a trap designed to drive mice outdoors, sparing their lives and then aggravating the customer

- A ‘mercy model’ that efficiently catches the mouse without inflicting injury.

- A subscription service in which trained exterminators set and check traps, or mercy models, over a three-day period each month

Indeed there is a way to build a better mousetrap or develop alternatives that would increase customer satisfaction and choice while positioning the company with a more differentiated and competitive offering.

Example 4: A bricks-and mortar retailer

A regional women’s clothing retailer wants to ward off online and big box competition by potentially making changes to different aspects of their business. They have several criteria for survey respondents to assess and rank by importance:

- A community give-back program in which customers who bring in lightly used clothes for the needy get a 15% discount on new purchases

- An assigned personal shopping assistant who will meet the customer by appointment to help with clothing choices and recommendations.

- A focus on locally sourced clothing and accessories made from regional artisans

- A cyber-price match that will match any online price for items under $75

- A new coffee and clothing model with an in-store coffee bar and inviting decor and comfortable seating

The results will help the retailer get a better grasp on what motivates their customers to shop in their store, and what combination of offerings would be most attractive to boost customer satisfaction and attract new shoppers.

Advantages of discrete choice-based conjoint analysis models

Discrete choice-based models offer a range of benefits that can provide useful insights and data-driven direction to the company conducting the survey.

- The ability to estimate psychological trade-offs that consumers make when evaluating several attributes together

- The ability to uncovers real or hidden drivers which may not be apparent to respondents themselves

- The methodology mimics realistic choice or shopping tasks and in some instances researchers are able to use actual physical objects to elicit more authentic and meaningful responses.

- If appropriately designed, the method can model interactions between attributes

- It can be used to develop needs-based segmentation in some instances

There are some potential downsides to discrete choice-based models.

- Designing conjoint studies can be complex and time-consuming

- When facing too many product features and product profiles, respondents often resort to simplification strategies

- It’s difficult to use for product positioning research because there is no procedure for converting perceptions about actual features to perceptions about a reduced set of underlying features

- Respondents are unable to articulate attitudes toward new categories, or may feel forced to think about issues they would otherwise not give much thought to

- Poorly designed studies may over-value emotionally-laden product features and undervalue concrete features

·

A look back and forward

If you pursue conjoint analysis you can do so knowing that it has an impressive and interesting past.

In today’s society, conjoint analysis continues to be one of the most effective analysis tools for marketing, product management, and operations research. Putting it to work in your organization can help you get laser clarity on the just-right blend of features or services to satisfy your customers and keep your business on a strong growth trajectory.

Get started with your market research

Global survey panel

Collect market research data by sending your survey to a representative sample

Research services

Get help with your market research project by working with our expert research team

Expert solutions

Test creative or product concepts using an automated approach to analysis and reporting

To read more market research resources, visit our Sitemap.