How to find survey respondents in 5 easy steps

Learn how to send your survey to the right people with these tools and tips from our survey research experts.

You’ve done the work to design a great survey, including questions that should help you meet your research goals.

Of course, when you set a survey goal, you define who you want to take your survey. You may want to reach people with specific demographics like age, gender, and location. But where do you start? How do you find survey respondents who meet your criteria?

In this article, you’ll learn five strategies for finding survey participants who can get you valuable insights. Keep reading for tips from survey research experts, best practices, and resources you can use today.

How to find survey respondents who give quality feedback

The saying “quality not quantity” applies here. Getting a large volume of people to take your survey doesn’t necessarily lead to relevant and useful data. Instead, make sure that you’re surveying qualified people who can give you information you can actually use. These five strategies will help you find survey respondents that provide valuable market insights.

1. Get to know your ideal survey respondents

Effective data analysis in market research relies on finding the right survey respondents. You should also include a minimum number of participants from your target population for statistical significance.

Statistical significance ensures your survey results have a specific cause (and aren’t due to chance). Proving statistical significance will help you make informed decisions and add credibility to your survey analysis report.

Calculate how many people need to take your survey

Before identifying your target sample population, you need to figure out the minimum sample size for a survey. For example, if you want to know whether consumers will like your new tagline, you need a minimum number of people to give you feedback so you can be confident in your findings.

Determining the correct survey sample size is a key step in collecting useful, accurate data. Here are a few tips:

- Generally, the more people you survey, the lower your margin of error. (How much your survey results may differ from how your target audience truly feels.)

- Consider your demographics. Is your target audience diverse or do people share many of the same characteristics? Review the different types of sampling to see which method works best with your research goals.

- Use a sample size calculator to find sample size for your project. You need to enter your desired confidence level, which is how sure you are that your results reflect the population you’re surveying. The industry standard is a 95% confidence level.

Consider running a focus group or interviews

Once you know how many respondents you’re looking for, you can turn your attention to who you want to survey. It can help to run small focus groups or interview customers to learn more about your potential target audience.

For example, a few questions could help our tagline researchers eliminate a subgroup of participants, paving the way for more qualified respondents. They won’t want to interview people who aren’t likely to purchase the product their tagline advertises.

This extra step can be more financial and resource intensive, yet it has the added benefit of ensuring you have a clear idea of your target sample population.

Perform demographic and geographical segmentation

Now that you’ve got a clearer picture of the respondents who can add the most value with their feedback, demographic and geographic segmentation helps you develop a representative sample.

Considering our market researchers again, if they were looking to go global with their product tagline, they’d want to get input from international audiences (especially as words have varied meanings in different cultural contexts).

For example, they could use cross-tabulation to better understand how different international demographics answered questions. This can help further segment their target audience and determine where their new tagline may or may not be a success.

2. Consider finding survey participants with an online panel

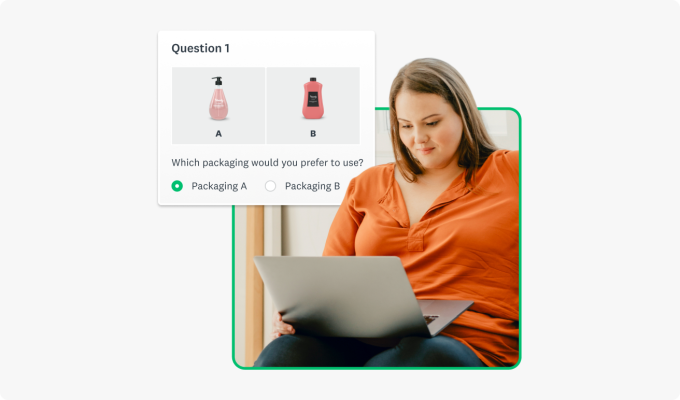

One of the most reliable ways to reach your target audience is through an online survey panel. For example, SurveyMonkey can find participants who meet your research criteria and are qualified to take your surveys.

Finding survey participants is a simple process:

- Create your survey or use a customizable survey template

- Choose the demographics you want to reach and where, including the US and over 130 countries

- We email survey invitations and you can analyze the results as they come in

3. Find survey participants across channels

You might also identify survey respondents by tapping into your existing data. Market researchers might log into their customer relationship management tool to identify past customers, loyal customers who have long-term exposure to the brand, or new customers who fit the target market profile. Or you might leverage your professional network to reach potential participants.

Send surveys through email

Email is a great tool for reaching survey respondents. Here’s why:

- You likely have a list of emails from lead generation efforts, promotions, customer lists, and more.

- You can define customer criteria for your email lists then efficiently send a compelling email asking people to take your survey.

- You can integrate surveys with your CRM or marketing automation platform to automate feedback collection from qualified respondents. (Note: Make sure to follow data privacy and GDPR policies.)

Spread the word with social media

If you don’t have existing contact information for your ideal target market, you can conduct your market research surveys on social media. You might post organically and rely on the power of your professional network and brand awareness. Or you can use paid placements to help get people to see and take your survey.

Website or app

You can also encourage survey responses by making it available to your website visitors or app users. This is useful as you are appealing to an audience that has sought your site or downloaded your app. They are more likely already engaged with your business. This could make them more willing to participate in your survey.

Make it convenient for this audience to participate by hosting pop-up surveys on your app or by embedding a survey or form into your website.

4. Use incentives to find survey participants

You can motivate potential respondents to take your survey with thoughtful incentives. For example, Xoxoday has found survey panel incentives entice up to 50% of non-respondents to participate.

Encourage survey participation with incentives such as:

- Product discount

- Loyalty reward points

- Brand swag

- Gift card

- Entry into a sweepstakes

This approach can increase the reach of your survey and may even enhance brand engagement along the way. However, offering incentives can also lead to people filling out the survey just to finish it rather than to provide honest, useful feedback.

5. Increase your chances of a good response rate

The typical survey response rate may not be what you consider a good survey response rate. Increase your survey completion rates with the following strategies:

- Review and use marketing survey templates to inform your survey design

- Keep your survey short and to the point

- Ensure your questions are clear to your audience

- Test your survey template out on a small audience to identify any issues people might have completing your survey

- Use the tools at your disposal to connect with your target market (e.g., email lists, partner networks, and online survey panels)

Worried that surveys won’t get you enough qualitative insights? When sending your surveys to larger groups, include some open-ended questions. This can help you understand the why behind your data. A good survey platform will include features like sentiment analysis and other ways to visualize qualitative data.

The easiest way to find survey participants

Now that you know how to find survey participants, it’ll be easier to get responses from a statistically significant sample size. Just remember that your survey results are only as good as your survey design.

Not sure where to start? The on-site experts at SurveyMonkey focus on survey methodology every day. Choose from hundreds of customizable survey templates designed for higher completion rates and reliable data. Or make your market research more effective and efficient with SurveyMonkey Audience, our global online survey panel. Get started today to gain valuable market insights in as little as an hour.

Ready to get started?

Discover more resources

Explore our toolkits

Discover our toolkits, designed to help you leverage feedback in your role or industry.

Unlock customer satisfaction (CSAT) with AI and automation

Tap into CSAT feedback faster using automation and AI features.

Product deep dive: Analyze and present your data

Learn how to analyze and present your data with SurveyMonkey.

What's new at SurveyMonkey?

See live demos of all SurveyMonkey's newest feature releases.