Key findings

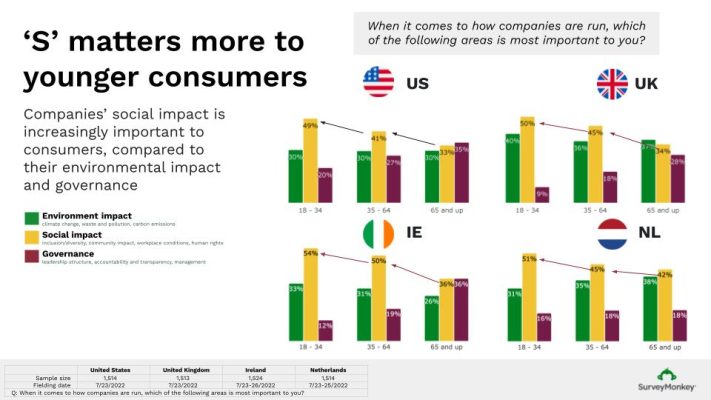

- ‘S’ matters more to younger consumers - companies’ social impact is increasingly important to consumers.

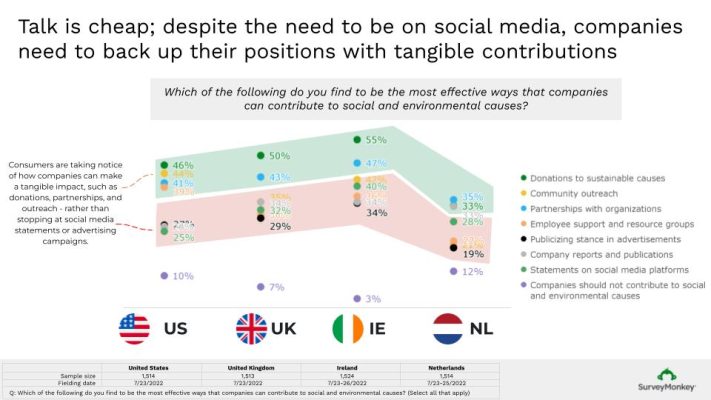

- Social media presence is more important than ever for companies, as younger age groups flock online to follow issues. However, companies also need to back up their positions with tangible contributions.

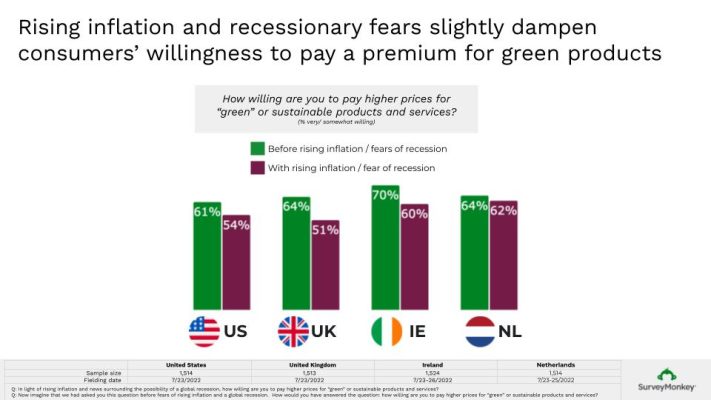

- Rising inflation and recessionary fears slightly dampen consumers’ willingness to pay a premium for green products.

‘S’ matters more to younger consumers - companies’ social impact is increasingly important to consumers.

Nearly half of adults across the US (49%), the UK (50%), Ireland (54%), and the Netherlands (51%) ages 18-34 say social impact is most important to them, compared with environmental impact or governance. Environmental impact is similar across age groups in the US and UK, more important among younger adults (18-34) in Ireland, and less important in the Netherlands among younger adults. Governance is least important among the three pillars of ESG across adults ages 18-34 across all countries, while on par with social impact among older adults ages 65 or higher in the US and Ireland.

Talk is cheap; despite the need to be on social media, companies need to back up their positions with tangible contributions

Consumers are taking notice of how companies can make a tangible impact, such as donations, partnerships, and outreach - rather than stopping at social media statements or advertising campaigns.

In the US, nearly half (46%) of adults say ‘donations to sustainable causes’ are the most effective ways that companies can contribute to social and environmental causes, followed by 44% who cite ‘community outreach’, 41% for ‘partnerships with organizations’, and 39% for ‘employee support and resource groups’. Only one in four cite publicizing a company’s stance in advertisements (27%), company reports and publications (26%), and statements on social media (25%) as effective. This trend holds for the UK and Ireland, where partnerships (35%) and donations (33%) are seen as the most effective, alongside company reports (33%).

Rising inflation and recessionary fears slightly dampen consumers’ willingness to pay a premium for green products.

Despite broad support for environmentally friendly products, brands risk consumers pulling back on spending on sustainable products due to inflation or recession fears. The US sees a 7 point drop in willingness to purchase green products due to such economic concerns, while the UK and Ireland both see double digit declines (13 points and 10 points, respectively). Consumers in the Netherlands remain committed to green purchases, with only a 3 point drop.

Read more about our polling methodology here.

Click through all the results in the interactive toplines below: