By most observations, consumer sentiment towards health and wellness has veered towards self-comfort and creative consumption in the past 12 months. From homemade bread to quaran-tinis and an explosion of work-from-home wear, consumers seem to have embraced a world where sweatpants rule and over-the-top indulgence is the new diet.

But that’s mostly for show. According to our 2021 SurveyMonkey Audience study of 1,606 adults in the US, consumers have been much more mindful about their health and wellness than their social media accounts might indicate. Here’s what we learned.

1. Positive progress (mostly) beat out negative feelings

After a year of volatility and lockdowns where consumers were deprived of their usual fitness and eating routines, we got curious about consumers’ health habits. So, we asked consumers to give us insight into their feelings, behaviors, and spending habits related to their health.

We were surprised that the large majority of consumers feel that their lives are generally healthy.

82% of consumers say their lifestyle is at least somewhat healthy

And, a third of consumers reported that their lifestyle was very or extremely healthy.

However, when asked how the pandemic affected how they cared for their health, consumers were divided on whether it was a motivation, an excuse, or a marathon.

- 43% said they use the pandemic as a reason to improve their health habits

- 12% said they use it as an excuse to neglect their health

Diet and fitness were top of mind for consumers with over a third of respondents saying they are exercising more and eating healthier than they were 3 months ago.

A third of consumers are exercising more and 34% are eating healthier than they were 3 months ago

And, a surprising number of people are open to shortcuts: when asked if they would choose strenuous exercise or a medical procedure to improve their health, 23% of consumers voted for the procedure.

Deeper dive: We used cross-tabs to understand the attributes of these “healthier” thinkers. People under the age of 24 have the most confidence in their healthy lifestyle, with 46% reporting they are very or extremely healthy, compared to 43% of people 75 and older, the second highest group.

2. Intentions are strong although motivation and discipline are a work in progress

One thing hasn’t changed after a year of sweatpants and loungewear: people still set high goals for weight loss, and have good intentions to change their eating habits to get there.

Over half of consumers (57%) said they are likely to alter their diet in the next 12 months to lose weight

However, consumers struggle with dieting for a variety of reasons; from discipline to cost. According to our research, these are the top 3 reasons why they aren’t eating as healthy:

- 33% can’t stick to a healthy diet

- 25% don’t have time to make healthy food

- 22% can’t afford healthy food

For consumers who are interested in getting started, here’s what would get them to try a new weight loss product:

- 43% low cost

- 42% easy to stick to

- 30% a trusted brand

The least valuable marketing angle for consumers? Before and after pics, which were only of interest to 12% of respondents.

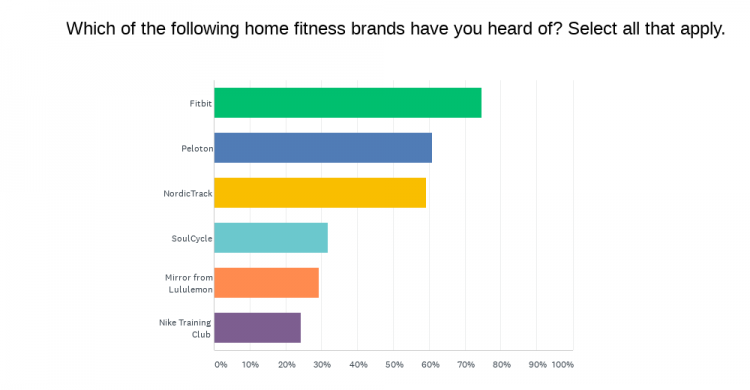

According to our survey, here’s how consumers ranked their awareness of the leading home fitness brands:

3. Fitness goals weren’t hampered by yearlong pandemic

It might have been easy to hide a lack of fitness during 2020, with video calls replacing meetings and many in person events getting cancelled. But, the home fitness was reinvented during the pandemic and consumers were willing to experiment with a variety of options. From online training sessions to watches and health trackers, almost a third of respondents are using home fitness equipment, and over 24% are using workout apps and wearables. Top options include:

- 32% using home fitness equipment

- 28% using fitness or workout apps

- 24% using fitness or workout wearables

Why people aren’t exercising as much as they should? The top reasons include:

- 53% are not motivated to exercise

- 35% are too tired

- 29% can’t stick to a routine

The good news for fitness companies is that consumers indicate a solid intent to invest in their fitness over the next 3 months. Taking vitamins and supplements top the list, and a significant portion of respondents said they plan to purchase home fitness products or gym memberships.

The deeper dive: We were curious about gender differences in consumer fitness commitments, so looked at our cross-tab reports for data. We found that men have upped their fitness game, with 30% saying they exercise more now than 3 months ago, compared to 25% for women.

But, women set a higher bar for good intentions. In 2021, 38% of women plan to eat healthier, compared to 27% of men, and 30% plan to hit a weight loss goal, compared to 21% for men.

Have your own questions about the health and fitness market? Learn how to run your own consumer behavior surveys with our all-in-one market research platform.

Learn more about SurveyMonkey Market Research Solutions

Methodology:

This study was conducted using SurveyMonkey Audience between January 7-21, 2021 to acquire a national sample of 1,606 adults in the U.S. The sample was balanced for age, gender, and US Region according to the Census Bureau’s American Community Survey.