Why you should care about the Customer Effort Score (CES)

Customer Effort Score (CES) is proven to predict customer loyalty and is a great tool for any CX team.

Most customer service professionals know the most common customer experience (CX) metrics: Customer Satisfaction (CSAT) Score and Net Promoter Score® (NPS®). NPS asks customers how likely they are to recommend a company to their friends or colleagues, while CSAT typically asks customers to rate the quality of specific experiences.

These CX metrics give companies vital insights into team performance and customer happiness—while illuminating strengths and weaknesses that impact big-picture goals, like reducing churn and growing revenue. But on their own, CSAT and NPS could exclude a vital piece of the customer experience equation: the amount of effort a customer exerts to resolve an issue.

That’s where Customer Effort Score (CES) comes in. Keep reading to learn what it is, how it’s measured, and why it’s vital.

What is Customer Effort Score?

Customer Effort Score asks the customer to score the level of effort involved with a specific interaction. CES is often used in customer service or other routine experiences where low effort is the main loyalty driver. For example, after a customer accesses a support article on a website, they may be asked to rate how easy it was to resolve their issue.

Why is CES important?

When customers encounter high levels of effort, it often indicates areas that need improvement, such as complex processes or inadequate customer support. Measuring CES not only provides valuable insights into your customer journey but also serves as a catalyst for enhancing it by pinpointing areas that need improvement.

How to measure Customer Effort Score

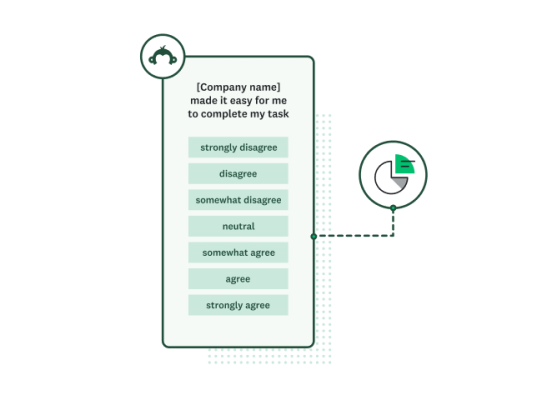

The CES survey asks customers to agree or disagree with the statement: “[Placeholder for company name] made it easy for me to handle my issue.” The respondent can choose from 7 answer choices ranging from strongly disagree (score 1) to strongly agree (score 7). Here’s an example:

If someone gives you a low score, ask them why—this will help you identify trends and better understand how to take action. For example, ask, “Can you tell us more about your experience? It sounds like we could have done better.” Responses could include:

- The agent didn’t understand my question

- The agent wasn’t knowledgeable

- The wait time was too long

- I didn’t get my question answered

- The product doesn’t have the functionality that I need

Lastly, add an open-ended survey question after the CES question to gather more feedback.

When to measure customer effort

The CES question can help you collect more meaningful insights at any stage of the customer journey, but it’s instrumental after these key customer touchpoints:

- Customer service interactions (e.g., phone, email, social media, in-person)

- Purchases or sales interactions

- Program or service sign-ups

- Website visits

- Online checkouts

- Customer meetings or consultations

Measuring customer effort is particularly relevant if you support your customers over multiple channels. In fact, the modern concept of omnichannel service is about reducing friction between service channels and minimizing customer effort.

Once you start collecting customer feedback, you’ll have CES results to compare alongside your CSAT results (and Net Promoter Score, if you include the NPS question in your customer service surveys). You get a whole new layer of customer feedback that colors your data. With more context, you can pinpoint weak processes and channels and take steps to improve them.

Customer service interactions

CES surveys ask customers to rank how difficult it was to solve a pain point they experienced with your business. Send Customer Effort Score surveys immediately after a customer contacts your service team with an issue or problem.

This could be after a customer’s email support ticket is closed or after they finish reading a FAQ article in your online resources center. Sending surveys after these interactions allows you to see how effective your support systems are at solving customer problems.

See how Customer Service teams can decrease churn, boost loyalty, and create strong customer relationships.

Purchases or sales interactions

Your business should also ensure it’s easy for customers to purchase your products or services. Afterall, you don’t want to put up barriers to increasing revenue. Post-purchase surveys let you ask your customers how their purchase experience went right after completion. Did they think everything went smoothly, or were there bumps in the road that almost made them abandon their purchase? It’s vital to understand how efficient the path to purchase is for your buyers.

Program or service sign-ups

When a new customer signs up for your program or service, you want that process to go as smoothly as possible to start the customer experience off on the right foot. Once the signup is completed, sending a CES survey will give you a good idea of existing pain points, allowing your team to solve them. For example, you may find you’re asking for too much information in the sign-up process. In this instance, eliminating a few fields in the account signup process will likely yield more conversions.

Website visits

Your website is the welcome mat to your business; it’s essential to be sure that it is well-designed and helps users find the information and products most relevant to their interests.

Online checkouts

Online checkouts play a critical role in the success of e-commerce, but they frequently contain bugs or problems that discourage potential customers from finalizing a purchase. To identify and address these issues in your online checkout process, consider implementing a Customer Effort Score survey after a purchase has been either completed or abandoned. This will help you gain valuable insights into the user experience and improve your checkout process.

Customer meetings or consultations

If your sales or customer success team conducts customer meetings or consultations, you’ll retain more customers if those teams make it easy for customers to solve their problems. Send a CES survey after a meeting to see how your business is doing and track your progress over time as you make improvements.

When to use CES, NPS, and CSAT

CES is not the end-all-be-all of customer experience metrics, though it’s valuable. It’s most effective when combined with the two other customer experience metrics: Net Promoter Score (NPS) and Customer Satisfaction Score (CSAT). These metrics work together but are not interchangeable, so knowing when to use each is important.

Customer Effort Score

As discussed in this guide, CES is best employed as a means for measuring customer effort. For example, how easy are you making it for your customers to make purchases, solve problems, and generally interact with your business? This metric is less about creating happiness and satisfaction, and more about avoiding unnecessary customer effort.

Net Promoter Score

Net Promoter Score measures long-term customer loyalty. It’s measured by asking customers how likely they are to recommend your brand, products, or services to a friend or colleague. Additionally, NPS will determine if your customer experience is creating loyalty over the long term.

It helps you determine which customers are brand ambassadors and which customers are more likely to defect to your competitors.

Customer Satisfaction Score

CSAT is measured by asking customers how they would rate their satisfaction with your business, an interaction, or a product or service. Customer Satisfaction Score can help you measure and improve specific touchpoints along the customer journey, so it should be limited to asking about one touchpoint at a time and tracking progress for enhancing that touchpoint. If CSAT is lower at one point of the journey, you can focus your efforts there to begin making effective improvements to the customer experience.

Improving customer service with CES

Predict follow-up questions and address them proactively

Companies can lower call-back and case reopen rates by training their customer service team to answer common follow-up questions proactively. For example, suppose your team fields many password reset questions, and customers tend to email again asking for the link to manage their account. In that case, your customer service reps should start including that link in their initial response. This simple addition can majorly cut back and forth, saving your reps and customers time.

Make self-service easy

No one likes to yell “representative” into a phone a hundred times only to get directed to the wrong place by an automated voice. If you want to make your customer service processes effortless, then look to your self-service tools first. Modern customers are comfortable seeking answers on their own. In fact, many people prefer resolving issues on their own. You can deflect tickets and reduce customer effort by enabling customers with the resources they need to solve problems themselves.

Ask your frontline team for feedback

Quantitative survey data is important, but never discount the qualitative feedback your reps get daily from customers. More than anyone else at your company, your customer-facing employees know the struggles your customers are facing, and they’re the first people you should consult when trying to resolve those struggles. Ask your frontline team what unhappy customers tell them, and create a system for logging this feedback alongside your survey results. Even better, build an internal survey so your reps can submit the feedback they hear on the fly.

Reduce employee effort

High employee effort equals high customer effort. If you want to minimize customer effort and improve the overall customer experience, you have to give your customer-facing employees the agency to make decisions and take action. The more obstacles you put in their way, the harder it becomes for them to deliver quality service.

Leveraging CES for improved loyalty

No doubt, customer loyalty drives business forward. But to get there, you must first recognize what drives customer loyalty. Low-effort experiences highly predict customer loyalty, while high-effort experiences correlate with customer churn.

Remember how each metric (CES, CSAT, and NPS) offers unique insights into your customer experience when planning your feedback program. Measuring any of these three is a great start, but you’ll get the most actionable feedback when you employ all three together.

The ultimate guide to customer service

Three priorities to help Customer Service teams decrease churn, boost loyalty, and create strong customer relationships

Net Promoter, Net Promoter Score, and NPS are trademarks of Satmetrix Systems, Inc., Bain & Company, Inc., and Fred Reichheld.

Discover more resources

Customer satisfaction survey templates

Explore our customer satisfaction survey templates to rapidly collect data, identify pain points, and improve your customer experience.

See how Ryanair collects customer insights at scale

Discover how Ryanair uses SurveyMonkey and its Microsoft Power BI integration to track 500K monthly CSAT surveys and improve customer experiences.

CSAT calculator: Measure and interpret customer satisfaction

Is your company meeting customer expectations? Use our free CSAT calculator to assess your Customer Satisfaction score and drive profits.

Customer Behavior Analysis: A Complete Guide and Examples

Read our step-by-step guide on conducting customer behavior analysis. Learn how to collect data and improve customer touchpoints.