The ultimate guide to building effective customer feedback programs

Customer feedback is the cornerstone of every successful business. Gathering feedback allows an organization to hone its products, services, and customer interactions with confidence. Rather than making inferences blindly, feedback provides a roadmap to creating better customer experiences (CX).

Considering that 89% of CX pros believe that the customer’s experience is the leading contributor to churn, investing in customer feedback programs is an investment in your company's longevity and success.

While there are distinctions between business-to-business (B2B) and business-to-consumer (B2C) feedback programs, the main pillars of a great strategy remain the same. In our ultimate guide to building effective customer feedback programs, we’ll dive into everything you need to know to create winning customer experiences, no matter your business model.

Chapters

CHAPTER 1

The importance of customer feedback in business

Customer feedback is invaluable for any business in today's competitive market. It provides direct insight into what customers think about your products or services, highlighting what you are doing well and uncovering areas for improvement.

By understanding customer needs and preferences, you can make informed decisions that enhance their overall experience, drive innovation, and build customer loyalty.

A feedback program is a centralized, systematic way to collect customers' voices and opinions. Actively seeking and responding to feedback demonstrates that your business values its customers, which boosts your brand’s reputation and loyalty.

What is customer feedback?

Customer feedback is the information, opinions, and insights provided by customers about their experiences with a company’s products or services. It can be positive, neutral, or negative, including reviews, reactions, complaints, suggestions, and observations about products, services, and interactions. Collecting and analyzing this feedback helps businesses understand customer needs, identify areas for improvement, and enhance customer satisfaction.

There are numerous channels that your business can use to collect customer feedback, including:

- Surveys: Surveys are the ultimate way to collect customer feedback, as you can tailor a survey to virtually any interaction or topic.

- Customer support feedback: After a customer support call or chat, customers can leave feedback on the quality of the support they received.

- Review sites: Neutral review sites like Google Reviews, G2, Yelp, and Trustpilot are full of verified customer reviews.

- Social media sites: Customers can use social media sites to voice praise or criticism about their experiences with businesses.

- Sales team feedback: Sometimes, customers will give direct feedback on your sales process after engaging with your sales team.

- In-app feedback: Businesses with mobile applications can gather user sentiment and satisfaction directly within the app.

- Website feedback form: Add a survey or embed your form directly on your website to encourage visitors to share their thoughts, suggestions, or report issues.

Some feedback channels are more common in B2B, while others are more useful in B2C environments. For example, sales team feedback is more commonplace in B2B organizations, while social media reviews are more prevalent in B2C companies.

Why is customer feedback important?

Customer feedback is vital as it offers you clear insight into how your customers feel and what they want to see in the future. When you understand what your customers want, you can make effective decisions to improve their experience.

Effectively collecting, responding to, and implementing customer feedback allows your business to:

- Better meet customer needs: When customers routinely suggest something that your products or services lack, you’re able to find your next improvement. This direct form of meeting customer needs helps enhance satisfaction and advance your offerings.

- Identify areas to improve: Feedback that constantly highlights an area where customers feel you’re letting them down should be your first priority when looking for areas to improve.

- Measure customer satisfaction: Collecting customer feedback allows you to quantify the customer experience, creating a measurable way of working toward higher rates of customer satisfaction.

- Reduce churn and increase retention: When you remedy issues with your customer experience, you’ll reduce churn and boost customer retention.

- Make better business decisions: The best business decisions are ones that you know will pay off with happier customers and increased profit. Analyzing customer feedback gives you the insight you need to make data-driven decisions.

- Drive innovation and new product development: The insight you need to enhance your product comes from the people with the most experience using it. Listening to customer feedback leads you to find new ways to innovate and enhance your products and services.

- Differentiate from the competition: Customer feedback allows you to find gaps in the market where your customers don’t feel supported. Filling these gaps lets you stand out from the crowd.

- Build customer trust and loyalty: Responding to customer feedback and implementing their suggestions shows your customers that you care about what they say. There’s no better way to build loyalty than making your customers feel heard.

Customer feedback programs are the single most effective way of enhancing customer experience. From there, higher rates of satisfaction, boosted profit, and company growth are on the horizon.

Related reading: Tips and resources for building a better customer experience.

Examples of companies leveraging customer feedback

Many organizations use customer feedback to understand what their customers feel and use that insight to deliver better products and services.

Here are two examples of how two businesses partnered with SurveyMonkey to enhance their customer feedback systems and deliver winning experiences to their customers.

Golden State Warriors use feedback to build a state-of-art fan experience

Operating out of the Chase Center building, the Golden State Warriors had a unique opportunity to create a compelling fan experience. To do so, they requested customer feedback to learn more about their expectations and desires.

Leveraging SurveyMonkey, the Warriors developed and launched an exciting series of sophisticated surveys. With 20,000 responses across 30 surveys, the Warriors pinpointed how they could offer a more user-friendly experience both inside and outside of the Chase Center.

Leveraging the survey data enabled the team to pivot their customer experience strategies with confidence. Their data-first strategy helped them to better engage with their customers, resulting in a 19% increase in their Net Promoter Score® (NPS).

Read the full story of how The Golden State Warriors created a winning customer experience.

Carrot improves clinical outcomes with member feedback

Carrot is a personalized platform that helps members get the care they need on their family-building journey. Every member on the platform has a unique situation and can have a vastly different range of needs. Carrot needed a scalable way to collect pre- and post-intervention patient views to improve outcomes and measure their success rate.

Leveraging the HIPPA-compliant features offered by SurveyMonkey, Carrot gained clear insight into what each member is most interested in and how best they can service their customers. The SurveyMonkey integration with Zapier streamlined the delivery of this data to Carrot, creating a highly scalable form of data collection and analysis.

Using SurveyMonkey, Carrot was able to influence 50% of undecided patients to follow their ideal care path, enhancing results while retaining 100% HIPPA compliance. This partnership allowed Carrot to get the insight they needed to better understand their customer experiences and enhance the process for everyone.

Read the full story of how Carrot delivered a better clinical service with customer feedback.

CHAPTER 2

The importance of customer feedback in business

Organizations need full support from leaders and teams across their business to develop an effective customer feedback program. Although you can share facts like 91% of customers will share a positive experience with their friends and family, it also helps to get real-world data from your business.

Here’s how you can get stakeholders at every level on board with creating a customer feedback program.

Identify program stakeholders

The first step in building a customer feedback program is identifying who will be involved. Various teams will be essential for collecting, analyzing, and acting on feedback.

Don’t worry, you don’t have to select one or two individuals for this stage. On the contrary, you’ll have numerous feedback program stakeholders all across your company. For example, your stakeholders may include:

- Frontline employees: Customer-facing staff members who interact directly with customers and gather feedback in real-time.

- Customer support teams: Representatives who handle customer inquiries, complaints, and feedback through various channels.

- Customer success teams: Professionals focused on onboarding customers, ensuring proper product usage, and driving customer satisfaction and long-term success.

- Product development teams: Professionals responsible for designing, developing, and improving products or services based on customer feedback.

- Marketing teams: Individuals responsible for creating marketing materials, which are often customers' first interactions with your business. They play a key role in bringing in and retaining customers.

- Sales teams: Individuals involved in promoting products, acquiring new customers, and maintaining customer relationships.

- Leadership: C-level executives and senior management who provide strategic direction and allocate resources for feedback initiatives.

Each of these teams has something to gain from a well-run customer feedback program.

| Team | How they use feedback |

| Frontline employees | • Improve customer interactions and troubleshooting techniques • Relay on-the-ground insights to leadership |

| Customer support | • Improve response times and support satisfaction levels • Identify common pain points and develop processes to reduce customer friction |

| Customer success | • Develop strategies to prevent churn and foster long-term customer loyalty • Offer ongoing assistance and training to ensure customers reach their intended goals |

| Product development | • Generate new product or feature ideas • Prioritize product launches • Implement improvements based on identified bugs and pain points |

| Marketing | • Tailor campaigns to customers’ needs & preferences • Refine product positioning in the market |

| Sales | • Adjust communication strategies to better meet customer needs • Adapt sales strategies to align with evolving customer preferences and market trends |

| Leadership | • Prioritize initiatives, allocate resources, and shape long-term business strategies • Build a customer-centric culture • Measure performance and identify areas of improvement |

Obtaining buy-in from executive leadership

If executives and senior management don’t consider your program mission-critical, you won’t get the resourcing and funds you need to ensure its success.

To show why your program matters, you must demonstrate how collecting and acting upon customer feedback delivers results that leadership will love. Show how your program can benefit executives and teams across your company.

Here are four methods to show your leadership why investing in your feedback program is vital across every stage of the customer journey.

1: Illustrate the ROI of customer feedback

The easiest method to get your executive team on board when implementing a customer feedback program is to show demonstrable profit impacts. Showing the potential ROI of customer feedback programs will clarify why your business should invest in CX.

Once you’ve shown the profit benefits that great customer experiences offer, your C-suite will be much more accepting of your proposal. Once launched, you can show off your real-world impact using your own data.

Related reading: 10 strategies to maximize the ROI of your CX programs.

2: Align the program with organization-wide goals

Another useful way to increase the appeal of a customer feedback program is to demonstrate how it aligns with your organizational goals. Your feedback program should not be at odds with your goals, nor should it seem like a new and random pursuit.

On the contrary, you can develop a clear connection between the feedback program and your organization's broader goals. Pinpoint areas where customer feedback initiatives can support these goals.

For example, if your C-suite wants to boost sales, show the direct connection between customer experiences and enhanced revenue.

3: Launch a feedback pilot program

Sometimes, your leadership will need more than theoretical ideas and potential future benefits. If that’s the case, you can propose a small-scale pilot program. This program will help test the efficacy of your feedback initiatives before launching a widespread integration.

With a smaller program, you can easily collect customer feedback and see how your initiative will help the company in the long run. By running this pilot scheme over a period of three or six months, you’ll have plenty of data to show why it's time to expand to a full-scope implementation.

4: Showcase feedback success stories

Luckily for everyone, customer feedback programs aren’t something new. The biggest and best companies around the globe have been using these for decades. With that in mind, there are plenty of third-party case studies that you can turn to.

Skimming through how other companies have implemented customer feedback programs and the benefits they’ve generated can serve as the evidence that you need to convince your leadership.

Read SurveyMonkey success stories to learn how top brands leverage customer insights to deliver a better customer experience.

CHAPTER 3

Defining goals, objectives, and KPIs

Building an effective, centralized, and systematic customer feedback program from scratch isn’t simple. Your program must hold a central role in your company and wield enough influence to deliver insights and recommendations so teams can take action.

You must define goals, objectives, and key performance indicators (KPIs) to bring your customer feedback program to life.

Define customer feedback program objectives

In order to justify the need for a customer feedback system, it is essential to establish a target for your program that aligns with your company's goals. Start by setting a clear and achievable objective before proceeding with any other steps. This focus will help you identify the areas that will provide valuable insights and support your goals.

Begin by evaluating the current challenges your organization is facing. Then, convert these challenges into a specific and realistic goal for your program. This approach ensures that your feedback system has a clear purpose and is aligned with your broader business objectives.

Examples of CX program goals, objectives, and KPIs

Goal: Enhance customer satisfaction

Objective: Increase Net Promoter Score by 15% by Q4

KPI: NPS score

We aim to increase NPS by 15% over the next six months. To achieve this, we'll launch transactional and relational NPS surveys to track changes in this metric. Continuous monitoring and responding to feedback will help us identify improvement opportunities and implement them. After six months, we’ll evaluate the effectiveness of our customer satisfaction initiatives.

Goal: Improve product usability

Objective: Reduce the average time to complete a task on our website by 20%

KPI: Average task completion time

We aim to reduce the average time customers take to complete a task on the site by 20%. The KPI for this objective is average task completion time. Setting up monitors on the site will help track this figure over time, demonstrating whether product changes are effective.

By collecting customer feedback after critical touchpoints, our business can determine how to streamline customer interactions on our website. Implementing these changes can improve the online UX and enhance usability.

Related reading: How to use NPS surveys to create the best customer experience.

Goal: Improve customer retention

Objective: Decrease customer churn rate by 10% in Q3

KPI: Quarterly churn rate

To enhance customer retention, we aim to decrease the customer churn rate by 10% by Q3. We will measure the churn rate each quarter to establish a baseline and use it as an ongoing KPI.

Our strategy includes analyzing customer feedback, implementing targeted changes, improving customer support, personalizing interactions, and proactively engaging with customers. After making these changes, we will measure the churn rate again to determine if we are on track to achieve this goal.

CHAPTER 4

Collecting customer feedback

In this chapter, we will explore the various methods of collecting customer feedback, the importance of analyzing this feedback, and how to effectively implement changes based on the customer insights you yield.

Understand the types of customer feedback

Customer feedback can be any information customers give that reflects their experience with your business. That said, not all feedback comes in the same format. The information you get from your sales team won’t be the same feedback your customer experience team is hearing.

Here are the main types of customer feedback your business should be familiar with:

- Solicited and unsolicited feedback: Solicited feedback is actively sought out from customers through surveys, feedback forms, and direct requests for opinions, and can be tailored to address specific areas of interest. Unsolicited feedback is provided by customers unprompted through social media comments, online reviews, and emails, offering honest and raw insights into customer sentiments.

- Satisfaction and loyalty: Feedback on overall customer loyalty and satisfaction rates will reveal how your customers relate to your business. High satisfaction rates will lead to more profit and decreased churn, which is an essential form of feedback to monitor.

- Customer service support: Customer service is the backbone of your entire organization. By asking for customer feedback after support interactions, you can gauge how effective your CS team is and where they could improve.

- Website and in-app feedback: Your business can implement live feedback modules on your site or app. Whenever a customer interacts with a certain touchpoint, you can automatically trigger these feedback forms to load. This form of feedback will demonstrate how smooth your website or app experience is and whether there are any points of friction along the customer journey.

- Sales feedback: After completing a purchase, your customers can provide feedback to your business, commenting on how easy the process was. This post-purchase feedback is useful for learning more about the success of your sales process.

Determine feedback channels to gather insights

There are numerous channels for collecting customer feedback. Engaging with customers across several channels offers your business an extensive and nuanced feedback base.

Here are the top feedback channels you can use.

Surveys

Surveys are one of the most effective feedback collection methods available to a business. You can run a survey on a variety of topics, ranging from whether customers like your branding to how they would rate a conversation with your support agents.

There is an endless library of different survey templates that you can use to get precisely the feedback you need. Their flexibility makes them effective in measuring, recording, and evaluating the customer experience.

You can also send out customer satisfaction surveys on any platform you like. For example, you might include surveys directly on your website or even post them on social media to get as many responses as possible.

As an accessible format allowing anyone to give feedback quickly, customer feedback surveys are a top feedback channel.

Customer interviews

Customer interviews allow you to conduct a deeper level of qualitative research. Chatting with a customer in a 1-1 format ensures that the conversation flows in a direction that’s useful for your business. For example, you could contact a customer who’s recently left a review for your new product and ask them to expand on their review.

By preparing your questions ahead of time, you can get a comprehensive understanding of what they think. Customer interviews are a great tool if you need a nuanced level of feedback.

Focus groups

Focus groups offer the high level of qualitative detail that customer interviews have but expand them to larger conversations with more people. Focus groups with 8-20 customers allow your business to rapidly explore your customers' perceptions, attitudes, and preferences.

Focus groups are a great way to obtain detailed feedback quickly, especially when launching a new product or going through development stages.

However, agents who run these interviews should be wary of group mentalities. When discussing something in a big group, it’s easy for a few louder voices to drown out the nuance of your conversation.

Market research

Market research is another powerful way of collecting customer feedback. While wider research won’t directly discuss your products and services, it can give you an insight into what the industry thinks. For example, you might see that customers in your sector are increasingly looking for a specific new functionality.

By conducting market research regularly, you can monitor your competitors and generate a broader awareness of sector insights.

Related reading: How to get started conducting market research.

Social media monitoring

When customers share their opinions on your brand via social media, they’re likely to be honest. By monitoring your social media mentions (both tagged and untagged), you can scour different platforms for reviews. Searching through social media lets you find comments, reviews, and mentions that give you real-time feedback on your company.

Due to social media's nature, you’re likely to encounter a treasure trove of options, ideas, and reviews for your brand. You can combine these responses with NLP sentiment analysis tools to turn qualitative feedback into quantitative research.

Determine the right timing and frequency for collecting feedback

Another important aspect to consider when collecting feedback is how frequently you send feedback requests. Too infrequently, and you won’t have enough data to draw insightful conclusions from. Too often, you’ll overwhelm your audience, reducing their willingness to leave feedback.

Striking the balance between too many and too few requests will largely depend on your audience. For example, many users are acquainted with leaving customer support feedback after a service interaction. In that scenario, a pop-up window that triggers after each finished interaction wouldn’t be too extreme.

But if you use the same automatic survey collection every time your customers click on a new part of your website, you’ll rapidly frustrate them. Consider when your customers will be most receptive to your surveys and other forms of feedback to determine the right frequency for your business.

Ironically, you could even survey your customers to see if they feel like they’re giving too much or too little feedback!

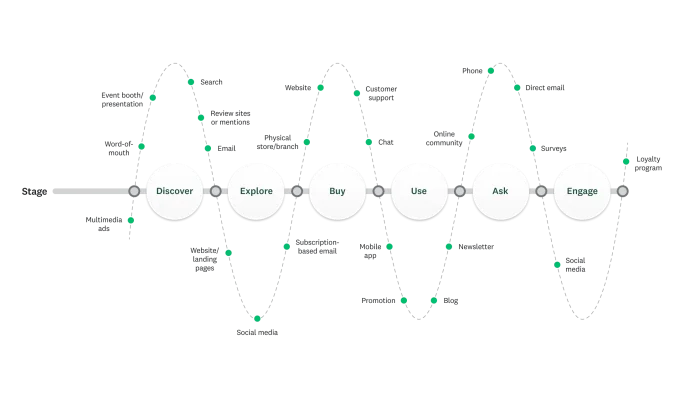

Collect feedback throughout the customer journey

Your business can collect customer feedback across the entire customer journey. Understanding the most important touchpoints in this journey and which are useful to monitor will help you create effective feedback request strategies.

Touchpoints can take many forms, spanning pre-purchase, purchase, and post-purchase interactions. By putting yourself in the customers' shoes, you can trace your customer journey and identify the most critical moments.

For example, you may realize that you don’t have much data on how customers respond to buying a product. Implementing customer feedback surveys just after a purchase touchpoint will solve this issue. Over time, you can use other forms of feedback capture to determine where your blind spots are.

Combining this with customer journey mapping will enable you to get feedback right when it's most critical. Remember, you can evolve these mechanisms over time. Trial, error, and constant iteration on your feedback capture process will help improve your customer experience monitoring.

CHAPTER 5

Best surveys for CX programs

Surveys are a versatile, concise, and accessible method of collecting customer feedback. When measuring the customer experience, you have several different potential survey formats to choose from.

Let’s break down the leading customer experience surveys, what they look like, and how they deliver your business the insight you need to thrive.

Net Promoter Score (NPS)

The Net Promoter Score measures how loyal your customers are to your business. The NPS is seen as the world’s leading customer satisfaction and loyalty metric, allowing you to track how your customers feel about your brand over time.

Launching NPS surveys is fairly easy, as you only need to ask one question: “How likely would you be to recommend this company to a colleague or friend?”

Respondents will then select their response on a scale of 1-10, with 10 being extremely likely and 1 being extremely unlikely. Answers with a score of 9 or 10 are promoters; scores of 7 or 8 are passives; scores of 0-6 are detractors.

Calculate the NPS, by using the following formula:

Your final score will be on a scale of -100 to 100. To see how you're progressing over time, you can benchmark your score against industry data or compare it to past quarters’ calculations.

Related reading: 10 tips to build stellar NPS surveys.

Customer Satisfaction Score (CSAT)

Customer Satisfaction Score is an easy-to-use survey that measures how satisfied your customers feel with a particular interaction or experience with your company. For example, you could use a CSAT survey after customers check out to measure their purchase satisfaction.

The CSAT survey uses a similar question every time: “How would you rate your satisfaction with X on a scale of 1 [very unsatisfied] to 5 [very satisfied]?” Here, X is the interaction for which you want to track customer satisfaction.

Once you’ve begun to collect responses to this question, you can use the following formula to calculate the CSAT score:

CSAT surveys are a fantastic way to check in at critical customer touchpoints and discover what your clients think. Learn more about why customer satisfaction is important (and how to focus on it).

Related reading: 50 examples of great customer satisfaction survey questions.

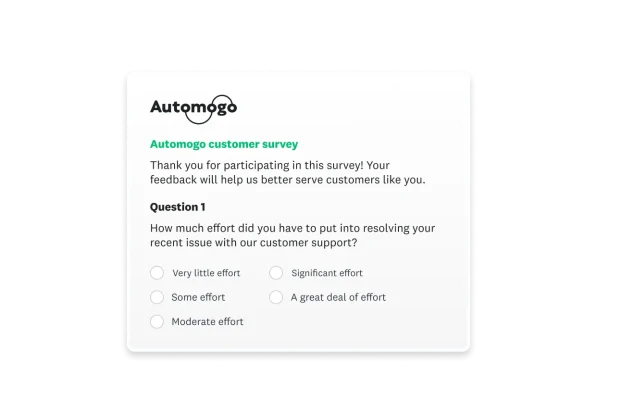

Customer Effort Score (CES)

Customer Effort Score is a customer experience metric that measures the relative effort a customer has to exert to complete an action with your business. CES surveys measure the total friction that customers experience when interacting with your company.

CES is important because 91% of customers will recommend a business after a low-effort, easy interaction. You can customize the exact CES question you ask to the specific task you’re examining.

Here’s a general question you might use:

“[Company] makes it easy for me to handle my issue with customer support.”

The responses to this can then vary from 1 (strongly agree) to 5 (strongly disagree). Businesses can then calculate CES by using the following formula:

You can understand why people leave a certain score by implementing open-ended feedback in your CES survey. Over time, you can identify issues with a process and remedy them to decrease friction at this touchpoint.

Related reading: How to use the Customer Effort Score.

Customer service surveys

A customer service survey allows your customers to give feedback about how your support team performs. These surveys offer insight into how your customer support teams can improve and enhance the customer experience.

On a customer service survey, you can ask questions like:

- Overall, how would you rate the quality of your customer service experience?

- How well did we understand your questions and concerns?

- How much time did it take us to address your questions and concerns?

Based on these questions, you can begin to quantify the quality of your customer service. Equally, your feedback will shed light on where you can give additional training to improve your team.

Related reading: What you should ask in customer service surveys.

Purchase satisfaction surveys

Purchase experience feedback allows your customers to share how easy, understandable, and intuitive they find your checkout experience to be.

A post-purchase satisfaction survey allows you to evaluate the customer’s purchase experience and identify areas to improve. In this survey, you’ll find questions like:

- Overall, how would you rate your purchase experience today?

- On a scale of strongly agree to disagree, I agree that the price was fair.

- On a scale of strongly agree to disagree, I agree that I could pay with my preferred payment method.

Get started with the SurveyMonkey post-purchase satisfaction survey template.

Customer exit surveys

Although it’s sad to see a customer leave, sometimes, this can be a valuable opportunity to gain insight. A customer exit survey questions customers who have decided to stop choosing your business.

An exit survey can ask some of the following questions to find out what you can improve for future customers:

- What was the biggest factor that made you no longer use [Company] products or services?

- Were there any specific products or features you found useful in our products or services?

- Is there anything you’d like to add to reflect upon your experience with [Company]?

CHAPTER 6

Analyzing and implementing feedback

Drawing insight from your customer feedback provides actionable steps you can integrate to improve. By constantly implementing feedback and requesting more feedback on your new features, you create effective customer feedback loops.

Identify feedback trends and themes

Continually collecting customer experience feedback over time and monitoring changes in your CX metrics allows you to gauge whether your feedback program has a positive effect. You can also actively benchmark your data to determine how your customer experiences shift over time.

Identifying feedback trends and analyzing their underlying reasons will help point you toward effective improvements you can make.

You can also identify specific trends by using filters in your data. A filter is a survey analysis tool that lets you focus on particular subsets of your data to see how specific groups respond to your questions.

For example, in an NPS survey, you could filter by your promoters. Once you look at their responses to your other survey questions, you might find something unique about their experience that can help you improve it for passives and detractors.

Alternatively, you could filter by a demographic question (if included) to see how different groups responded (e.g., length of time being a customer, company they work for, job title, etc.)

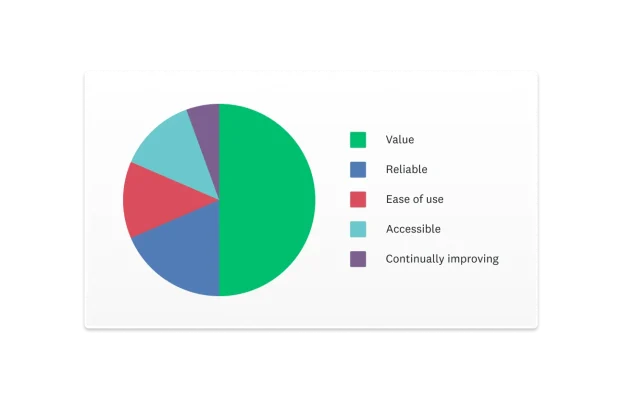

Use visualizations

Charts can help you visualize your results and convert complex data into an easily digestible format. For example, you could use a multiple-choice survey question to ask respondents what they like about using your product.

A bar chart, like the following, could help you make subtle comparisons across your answer choices:

Though close, you can see that value beats out the other options as your top differentiator.

Now, if you want to know what customers like about your product most, you can use a pie chart. This type of chart works great in accentuating the differences in popularity among choices:

This time around, it’s clear that value beats out the other options. There’s nuance in creating different kinds of charts. For example, a line/area graph can be created from a multi-select closed-ended question, while pie/donut charts can only be used from a closed-ended question that only allows a single answer.

Related reading: When and how to use SurveyMonkey’s most popular chart types.

Compare data from different customer touchpoints

When exploring related data across distinct customer touchpoints, you may encounter stark differences. Let’s say you were exploring satisfaction rates for customer service support via phone calls and web chat.

If these two touchpoints (which should offer the same level of support) receive opposing satisfaction rates, you can use this as a new line of inquiry. You could review customer feedback for both channels and discover why one service channel is rated better.

When comparing different touchpoints, the additional contextual contrast can reveal new patterns, trends, and ideas in your data.

Drawing conclusions

Reporting on survey results and drawing clear conclusions comes back to understanding the story that your data tells.

Examining the patterns you’ve identified in your data will often lead to potential conclusions. However, it’s important to understand causation and correlation before making too many assumptions.

Let’s say you receive customer feedback on a conference your business ran, and the majority of responses are negative. Upon digging deeper, you discover that almost every aspect of the conference was well-received, except for one: attendees disliked the city you chose for the event.

For instance, maybe you hosted the conference in Minneapolis in January, and the colder temperatures prevented people from enjoying the city. Initially, the data might suggest that the conference was an abject failure. However, after a closer examination, you realize the conference was great, but the location disappointed attendees.

From this realization, consider hosting winter conferences in warmer cities to enhance attendee satisfaction.

CHAPTER 7

Taking action on customer feedback

No matter how thoroughly you analyze your survey results, they won’t add value to your organization if they aren’t shared with the teams who can act on them.

Which teams care about which types of survey data? Let’s find out.

Share customer feedback with program stakeholders

Your program stakeholders can turn your data into powerful insights for their teams. You don’t need an advanced system for sharing customer feedback to be successful, you just need to make sure the right people have access to your data.

Here are some key strategies you can use to communicate insights obtained from customer feedback with program stakeholders:

- Full visibility: Some colleagues just need to dive into the complete data. If you want them to be able to analyze the responses however they see fit, just share the entire survey with them.

- Filters: Other colleagues may not have the time to dig through the data. Use filters to show them only the information they care about. Once you’ve found a view you like, edit the sharing permissions to “View Only,” and then share the survey results directly with them.

- Visualizations: Are you planning to use your results in presentations or handouts? You can export any chart from your data as a PDF or as a PowerPoint to easily use in meetings.

- Stats-first: Data-savvy colleagues might want to analyze your results more deeply. Try exporting your responses and sharing them as an SPSS file or a CSV file. They can then open the results in the programs they already use.

- Dashboard: Practically anyone can benefit from you presenting your data in an intuitive, easy-to-read Results Dashboard.

- CRM: If you’ve integrated SurveyMonkey with a CRM like Salesforce, it can automatically send relevant colleagues a notification when a customer responds.

Now that you know the options for sharing your survey data, you’ll need to ensure that your different teams receive the response data effectively.

Customer-facing employees are among the teams you’ll almost certainly share the responses with. After all, they’re the ones who can make the best sense of the responses for each customer and respond to them directly.

Choosing the best way to share your customer feedback with these employees depends greatly on the size of their team and what they’re looking for from the insights.

Here’s what each team will need to get the most from an NPS survey:

- Sales: They’ll want a list of promoters and their responses, organized by industry, location, and other demographics. They’ll use the responses to identify leads for cross-sell and upsell opportunities.

- Marketing: They’re looking for a list of promoters and well-known clients who could participate in marketing activities and whose responses they could use in promotional materials.

- Product: They’re interested in getting a representative sample of responses from detractors, passives, and promoters to understand what’s going well and what could be improved. They’re also eager to see the results from competitive NPS studies and understand how NPS trends over time.

- Leadership: They want to receive presentations explaining the changes in the NPS over time. They’ll also want to know your plans for responding to recent customer feedback, be updated on new learnings about your customers, and see the competitive NPS.

Prioritize action items

While all customer feedback is important, your response won’t be the same for every customer. Some feedback requires immediate attention. For example, if a customer has stated that they cannot access a service they’ve paid for, your support team should fix the issue as quickly as possible.

On the other hand, some feedback is worth replying to but doesn’t include the same sense of urgency. An example would be needing to respond to a promoter who’s left a positive review. Replying will help to increase that customer’s loyalty, but this doesn’t have to be done in the next 12 hours; it won’t be a make-or-break priority.

By understanding the scope of actions you can take based on feedback, you can prioritize where you first need to respond. Determine how a response aligns with your customer service and business goals. If a quick response enhances the impact of your customer service, it should be a top priority.

Where possible, prioritize your action items to get the most from customer feedback.

CHAPTER 8

Closing the feedback loop

If your business wants to continue receiving feedback, you have to respond to the feedback coming in and outline the actionable steps you’re taking to address it. Feedback loops only work when you respond to feedback, acknowledge your customers’ comments, and take action. These actions will then inspire further comments in the future, starting the loop again.

Closing the customer feedback loop:

- Builds trust: Responding to customers improves their relationship with your business.

- Improves credibility: Showing that your company is listening to customer feedback enhances your credibility and makes you more appealing to customers.

- Enhances customer experiences: Taking actionable steps to improve the customer experience based on the feedback will help boost customer satisfaction.

There’s a reason that 52% of customer experience professionals want to invest more in customer feedback programs. Closing the feedback loop is a win-win for everyone.

Closing the feedback loop with internal stakeholders

Closing the feedback loop with internal stakeholders, whether from marketing, product, sales, or leadership, is crucial for improving their respective business areas.

Involving internal stakeholders in the feedback process enables teams to understand how to effectively act on customer feedback. Communicate clear plans for how each team should address feedback and highlight the impact of their actions on fostering customer loyalty and enhancing the employee experience.

To keep teams informed and engaged, consider sending regular emails that showcase the outcomes of feedback programs. Utilize communication platforms like Teams or Slack for periodic updates and discussions. Closing the feedback loop with internal stakeholders demonstrates the value of their efforts and reinforces a culture of responsiveness.

Closing the feedback loop with customers

On your survey’s end page (the page they see after submitting the survey), let every customer know how much you value their feedback. The page can detail how you manage their responses and provide examples of what you’ve done with customer feedback in the past.

How you respond to clients can change based on your goals, customer base, and business size. Additionally, positive feedback will require a different response than negative feedback.

Here’s an example of how you could respond to positive feedback:

- Hi {Name}, We at [Company] appreciate you taking a moment to share your feedback about your recent interaction with our customer support team. We're thrilled to hear they were welcoming and friendly! By the way, did you know you can share the love (and get rewarded)? When you recommend our services to a friend, and they sign up, you'll both get an extra three months for free! Thanks again for your feedback, and have a lovely day!

Here’s an example of how you could respond to negative feedback:

- Hi {Name}, Thanks for reaching out about our pricing options at [Company]. We appreciate you taking the time to share your thoughts. We're committed to delivering a valuable service and understand that affordability is a major factor. We're excited to announce that we're working on a new pricing tier that will be more accessible to a broader range of customers starting in July. In the meantime, we'd like to offer you a one-month trial of our product at a discounted rate. That way, you can experience the total value we offer firsthand. Thanks again, and we look forward to hearing from you soon!

CHAPTER 9

Driving continuous CX improvement

In our final Chapter, discover how to enhance your existing customer feedback programs, measure your progress, refine your strategies, and create a more robust system.

Create a customer-centric culture

Creating a customer-centric culture should be at the heart of your company’s DNA. After all, businesses that invest in improving the customer experience see benefits across everything from boosted revenue to improved customer satisfaction rates to increased and long-term loyalty.

Beyond gathering customer feedback, it's also crucial to prioritize employee feedback. Employees who feel supported are more likely to deliver exceptional customer service. By actively collecting and responding to employee feedback, you can build a more positive, productive, and engaged workplace.

By resolving employees' challenges, you cultivate a workplace where they can fully embrace a customer-centric mindset. Ultimately, everyone in your organization must work together to prioritize CX, ensuring your business consistently delivers exceptional customer experiences.

Improve employee training and development

Once you understand the customer experience in more detail, you can take steps to deliver more value to clients. For example, you’ll be able to train customer-facing employees in the areas they need to improve on most, and you’ll be in a position to adjust your product roadmap to better meet your customers' needs and wants.

Providing ongoing training and development opportunities allows your employees to enhance their skills. As they become more proficient, they’ll actively deliver streamlined experiences to your customers. The more resources and training employees regularly have at their disposal, the better, especially for front-line staff who are in direct contact with your customers.

Related reading: Set your employees up for success with impactful training

Measure and monitor progress

Your job isn't over once you have a successful customer feedback program in place. It’s important to constantly measure performance metrics and feedback data to identify improvement areas.

Monitoring key customer experience metrics over time will also allow you to demonstrate the success of your customer feedback program. As your customer satisfaction rates improve over time, you take that data to your leaders to prove the utility of your CX program.

As you review your program, see if you can tie its performance to any type of financial success. It can be as simple as correlating an X% lift in revenue with an average improvement of Y points in your NPS. The more value you can associate with the program, the more support you’ll get from your leadership team.

Celebrate successes and learn from missteps

When employees feel recognized for their contributions, it enhances their commitment to delivering excellent customer experiences. Similarly, embracing failures as learning opportunities rather than setbacks is vital.

By analyzing what went wrong and adjusting strategies accordingly, you can continually improve your approach and ensure long-term success in building a robust customer feedback program. These moments of reflection and growth strengthen your team's resilience and drive continuous improvement in customer satisfaction and operational efficiency.

Build a world-class customer feedback program with SurveyMonkey

Our guide has explored the full extent of how to make, refine, sustain, and improve a customer feedback program. These best practices, tips, and insights will allow you to craft a winning program that your customers, leadership, and employees love.

As you refine your employee and customer experience, you’ll receive tangible financial returns alongside happier customers. Your business can leverage SurveyMonkey to get an all-in-one platform for collecting, analyzing, and drawing actionable insights from feedback. Get started today.

Net Promoter Score and NPS are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

Discover more resources

Customer satisfaction survey templates

Explore our customer satisfaction survey templates to rapidly collect data, identify pain points, and improve your customer experience.

See how Ryanair collects customer insights at scale

Discover how Ryanair uses SurveyMonkey and its Microsoft Power BI integration to track 500K monthly CSAT surveys and improve customer experiences.

CSAT calculator: Measure and interpret customer satisfaction

Is your company meeting customer expectations? Use our free CSAT calculator to assess your Customer Satisfaction score and drive profits.

Customer Behavior Analysis: A Complete Guide and Examples

Read our step-by-step guide on conducting customer behavior analysis. Learn how to collect data and improve customer touchpoints.